Preferred Mortgage Corp. of NY is now offering Temporary Rate Buydowns

Lower your interest rate at the start of your new home loan with a Temporary Rate Buydown. This rate buydown option is perfect for homebuyers looking for extra flexibility in their monthly payment and is ideal for buyers who expect an increase in their income in the next few years.

When is a temporary rate buydown helpful?

- There are excess seller concessions to use and want to take advantage of a low fixed rate

- Perfect for new home renovations, home upgrades, or new furniture

- Going from renting to buying and want to ease into their mortgage with a lower payment

- Expecting an income increase in the next few years

Choose between seller- or lender-paid Temporary Rate Buydown Options:

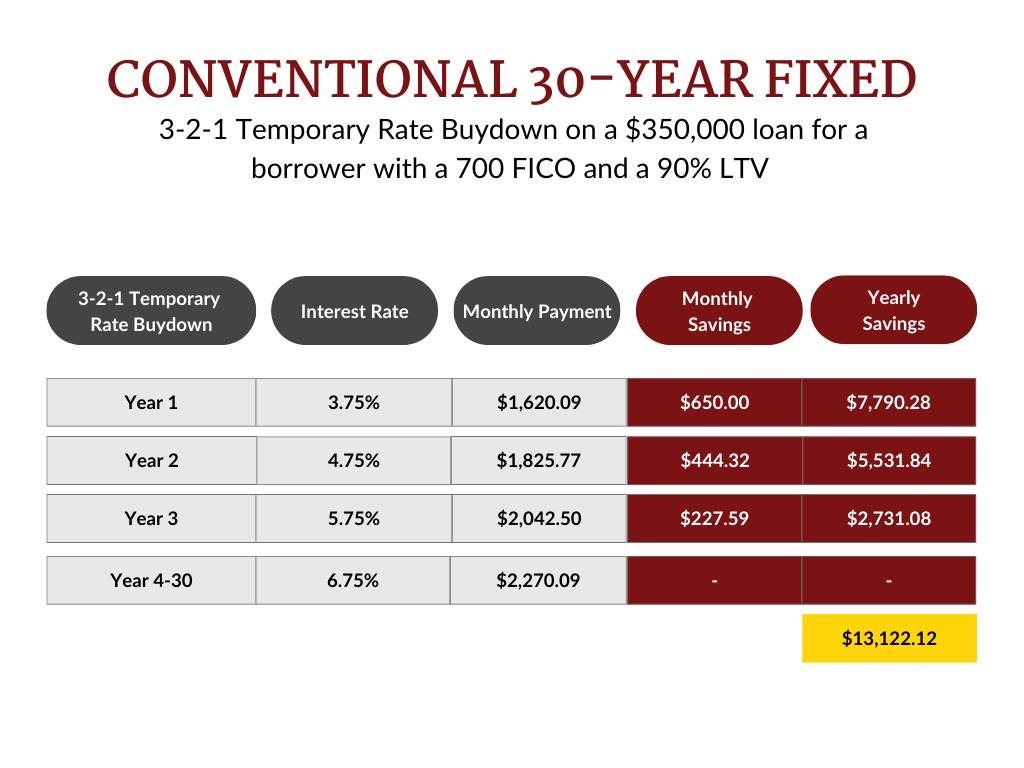

- 3-2-1 buydown: A buydown of 3% in the first year, 2% in the second year, 1% in the third year, then back to the original locked rate in the fourth year for the duration of the term.

- 2-1 buydown: A buydown of 2% in the first year and 1% in the second year, then back to the original locked rate in the third year for the duration of the term.

- 1-1 buydown: A buydown of 1% in the first two years, then back to the original locked rate in the third year for the duration of the term.

- 1-0 buydown: A buydown of 1% in the first year, then back to the original locked rate in the second year for the duration of the term.

Here’s an example of the potential savings on a 3-2-1 seller-paid buydown:

*The principal and interest payment on a $350,000 30-year Fixed-Rate Loan at 6.750% and 90% loan-to-value (LTV) is $2,270.09. The Annual Percentage Rate (APR) is 7.138% with estimated finance charges of $5,600. The principal and interest payments, which will continue for 360 months until paid in full, do not include taxes and home insurance premium, which will result in a higher actual monthly payment. Rates current as of 11/16/22. Subject to borrower approval. Some exclusions may apply.

- The borrower must qualify for the full monthly payment (before the buydown rate is applied)

- For the seller-paid option, seller concessions are deposited as a lump sum into a buydown account. A portion of this sum is released each month to reduce the borrower’s monthly payments.

Information is subject to change. Certain restrictions apply. Subject to borrower approval.

Qualify Today

Fill out the form below to get started or contact us.